Notifications on BordeauXchange

We are thrilled to announce the launch of our brand-new notifications page!

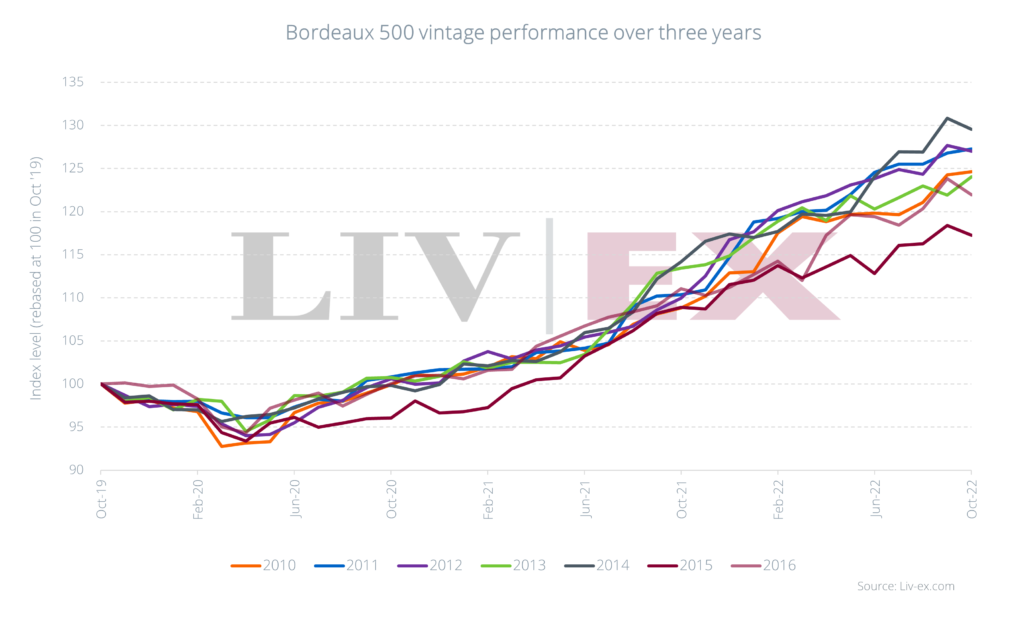

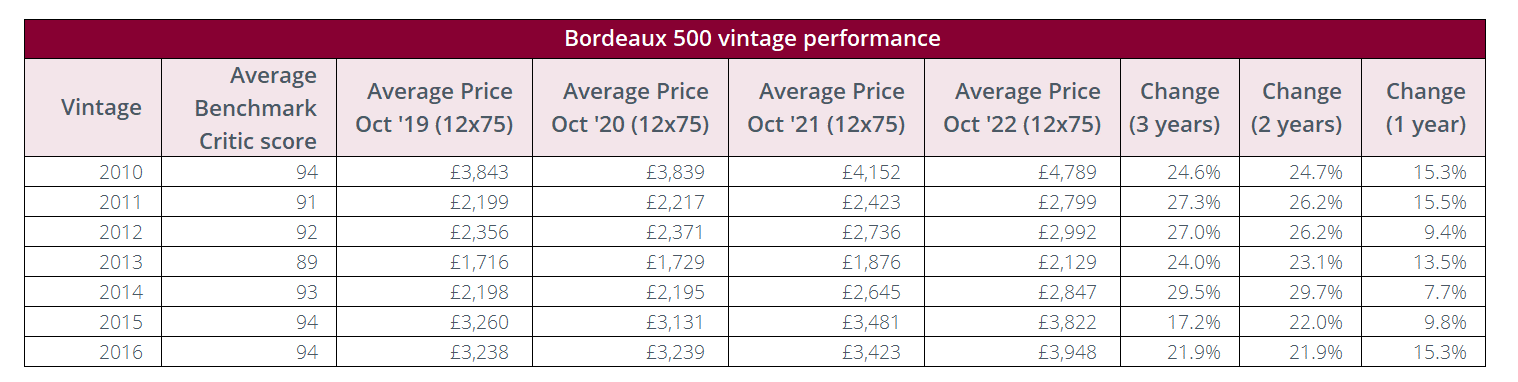

The 2014 has had the best three-year performance among Bordeaux vintages from 2010-2016, increasing by an average of 29.5%. Even though it has a lower entry point into the market, and has a lower critic’s score, its returns have outperformed outstanding vintages like 2010 (up 24.6%), 2015 (up 17.2%), 2016 (up 21.9%).

2014 is the modern era’s best-rated “off” vintage, with an average score of 93, and an average price of £2,847 per 12x75cl case. The 2015 and 2016 vintages carry an average score of just one point higher, but trade at premiums of +35%.

This value has not gone unnoticed, 2014 is currently the second-most traded vintage so far this year, demonstrating the market’s recognition of the value currently on offer.

Based on the wines in the Liv-ex Bordeaux 500 index, the table above displays the price performance of specific Bordeaux vintages over various timeframes.

Although the 2014 vintage is the best performing investment over three and two years, its upward trend has paused recently. here, the 2011 vintage has overtaken as the top performing vintage with a increase of 15.5%.

Top vintages have also seen price rises as a result of increased demand. 2010 and 2016 are two of the most popular vintages, and both are up 15.3%.

Weekly trade breakdown

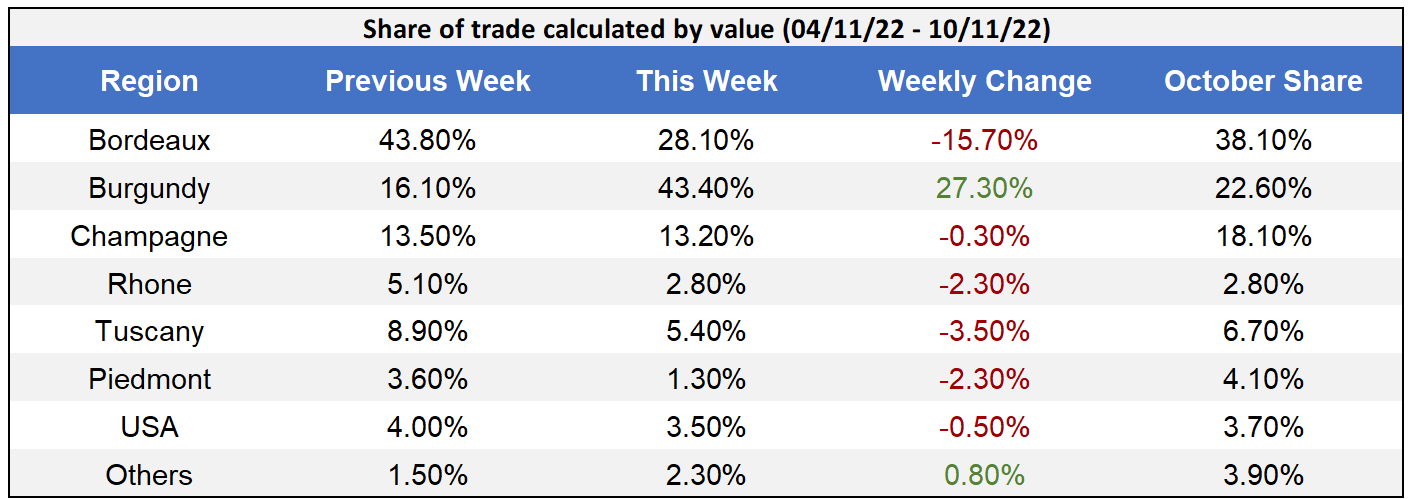

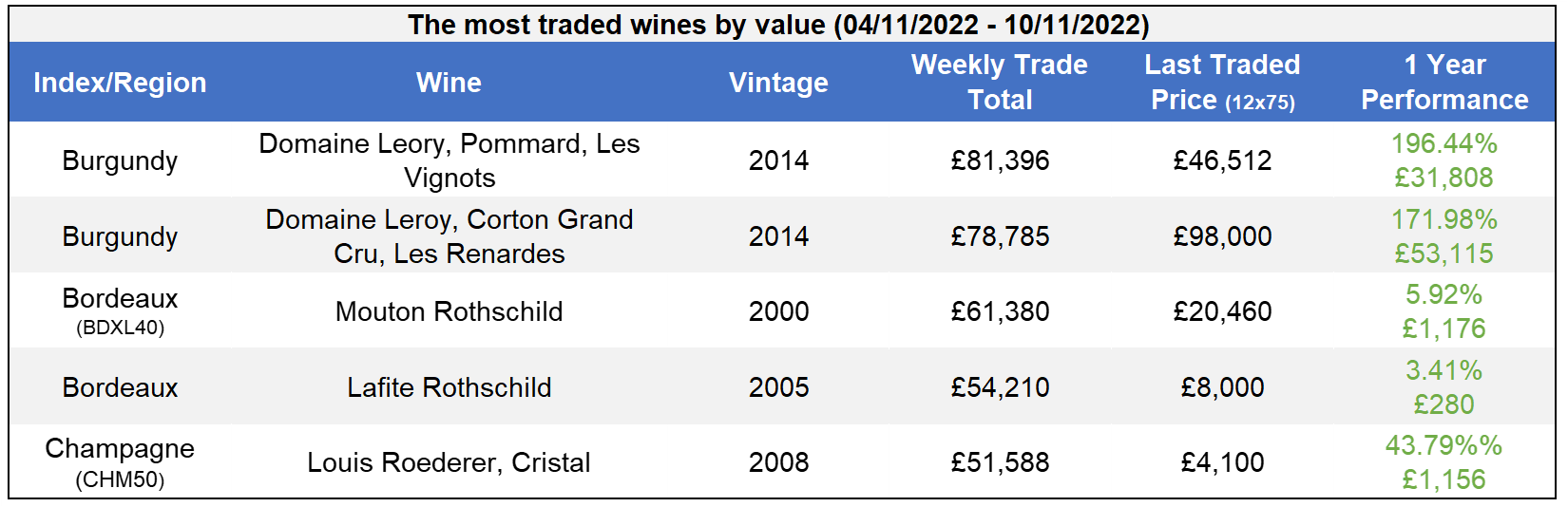

The high-value wines of Domaine Leroy, which is ranked by Liv-ex as the most powerful wine brand in recent years, helped Burgundy’s weekly trade share reach an all-time high of 43.3%. Demand for older vintages of Domaine de la Romanee Conti (DRC) like the 2003 and 1999 also traded in the limelight.

Bordeaux dropped to 28.1% share of total trade, with Lafite Rothschild, Mouton Rothschild, Petrus, and Ausone leading trade.

After another successful month as the top performing region in October, Champagne maintained its market share. High volumes of trade for multiples vintages of Louis Roederer Cristal were the leading force.

The trade shares of USA, Italy, and Rhone all decreased. The “Others” were this week’s biggest gainers, climbing from 1.5% to 2.3%.

This week’s top traded wines

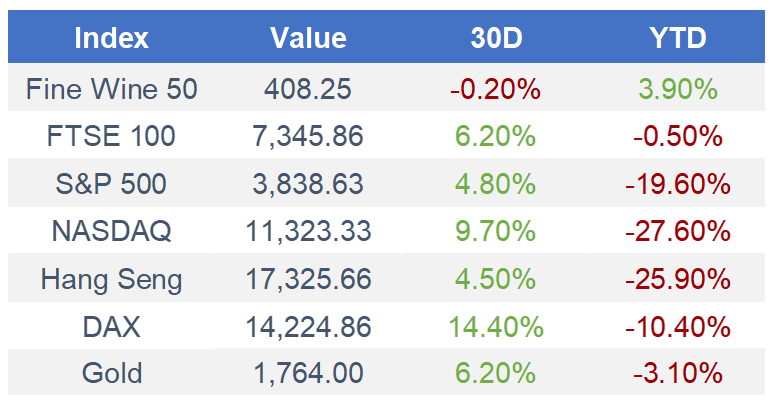

Daily Markets 11/11/2022

What we’re reading

Related Articles

We are thrilled to announce the launch of our brand-new notifications page!

You can now create and manage multiple portfolios from your BordeauXchange account

Notifications