Notifications on BordeauXchange

We are thrilled to announce the launch of our brand-new notifications page!

Fine wine stutters in October

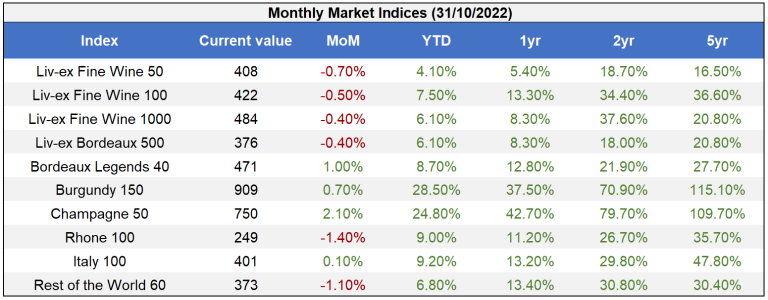

Of the leading secondary market indices, only the Liv-ex Fine Wine 1000 rose in October, up 0.2%. The Liv-ex Fine Wine 100 dipped 0.5% and the Fine Wine 50 was down 0.7%.

The Liv-ex 1000 was driven by the performance of the Champagne 50. The sub-index rose 2.1% in October and was the best performing of the seven sub-indices for the fifth month in a row.

Whereas Sterling weakness gave the market a boost in September, its stronger performance against the US Dollar and Euro in October reduced the buying power of those currencies.

In addition, a 33-year record hike in UK interest rates and warnings of a prolonged recession, as well as the continued absence of Hong Kong and mainland Chinese buyers have added to the headwinds facing the market.

Monthly trade breakdown

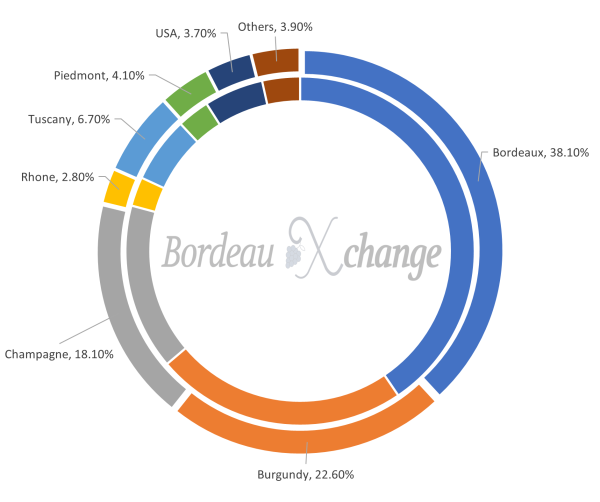

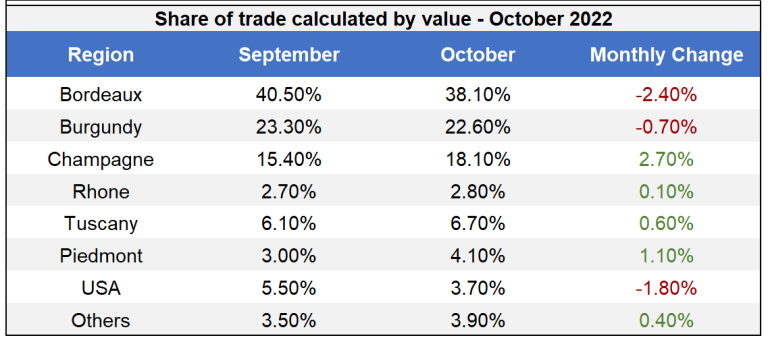

Bordeaux’s trade share declined from 40.5% to 38.1% this month and Burgundy’s went from 23.3% to 22.6%.

The USA saw the biggest decrease, down from 5.5% to 3.7%. Californian trade has been declining over the course of the year and the value traded in October was a quarter of that traded in January. The strong US Dollar has made stock in America (which accounts for a large proportion of Californian wines traded) more expensive for Sterling and Euro buyers.

Unlike other regions, Champagne’s trade share grew last month, rising from 15.4% to 18.1%. Once again, it was Louis Roederer’s Cristal that was at the forefront of Champagne trade. The 2014 was the month’s top traded wine, while Cristal 2008 and Dom Pérignon 2012were also among the five top-traded labels.

Top Performers

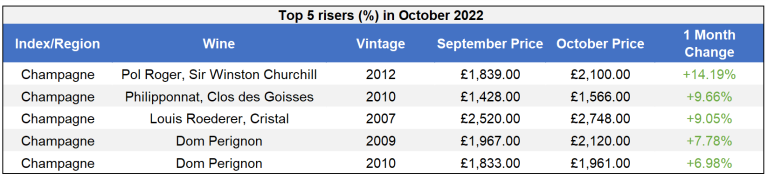

As mentioned above, the Champagne 50 was the best-performing sub-index of the Liv-ex 1000 in October.

The five wines in the chart above were the best-performing wines last month based on their Mid-Price change.

Few of the wines shown above have been the most actively traded vintages for their respective brands so far this year. For example, Philipponnat Clos des Goisses 2012 and Pol Roger, Sir Winston Churchill 2013 havetopped trade for their brands this year – rather than the 2010 and 2012 vintages shown in the table above.

Similarly, the 2008 and 2014 have dominated trade for Louis Roederer’s Cristal, and Dom Pérignon’s 2010 has seen higher demand for its 2012 and 2008 vintages.

Related Articles

We are thrilled to announce the launch of our brand-new notifications page!

You can now create and manage multiple portfolios from your BordeauXchange account

Notifications