Notifications on BordeauXchange

We are thrilled to announce the launch of our brand-new notifications page!

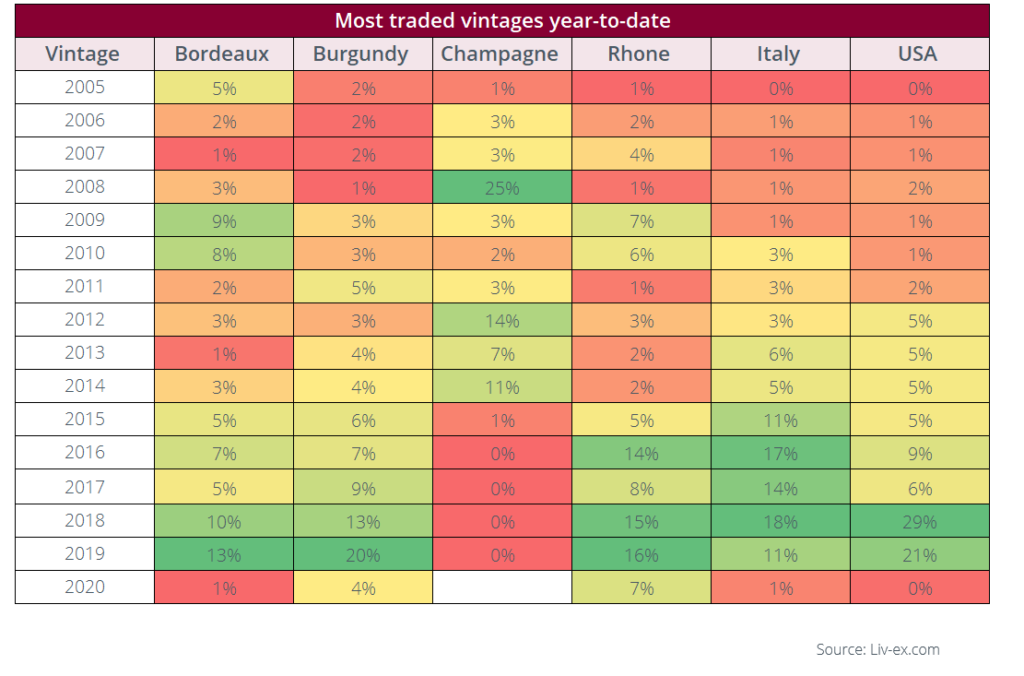

The secondary market is frequently thought of as a location to buy older vintages, however, recent trade data reveals that the most traded vintages are in-fact the most recent.

Accounting for 13.3% of all trade so far this year, the 2019 vintage is the most traded vintage on Liv-ex. However, different vintages take the top spot when examined by region.

Bordeaux has the largest variety of all regions. This is because it is the most established and accounts for 30-40% of all trade on the secondary market. Regardless of vintage, stock is readily accessible and prices are unlikely to spike on a regular basis.

In regions where supply levels are more constrained and prices for older vintages rise more significantly, trade is considerably more focused on recent releases. Take Burgundy and the USA as examples, where the top traded vintages are the 2019 & 2018 respectively.

Burgundy buyers have continued to seek for stock and value among the most recent releases within its appellations, boosting the variety of regional wines bought & sold on the secondary market.

The location of buyers also affects how well a vintage sells. Bordeaux is popular in Asia where people like vintages that are ready to drink, therefore, Asian buyers are more likely to purchase wines that are 10+ years old.

The USA, which is the largest buyer of Rhone wines, is renowned for buying the most praised vintages from industry critic’s. It therefore comes as no surprise that the most traded vintages (2018 and 2019), are also the highest scoring vintages from critic’s. Jeb Dunnuck remarked that between 2015 and 2020, the Rhone has been providing a “historical run of exceptional vintages”.

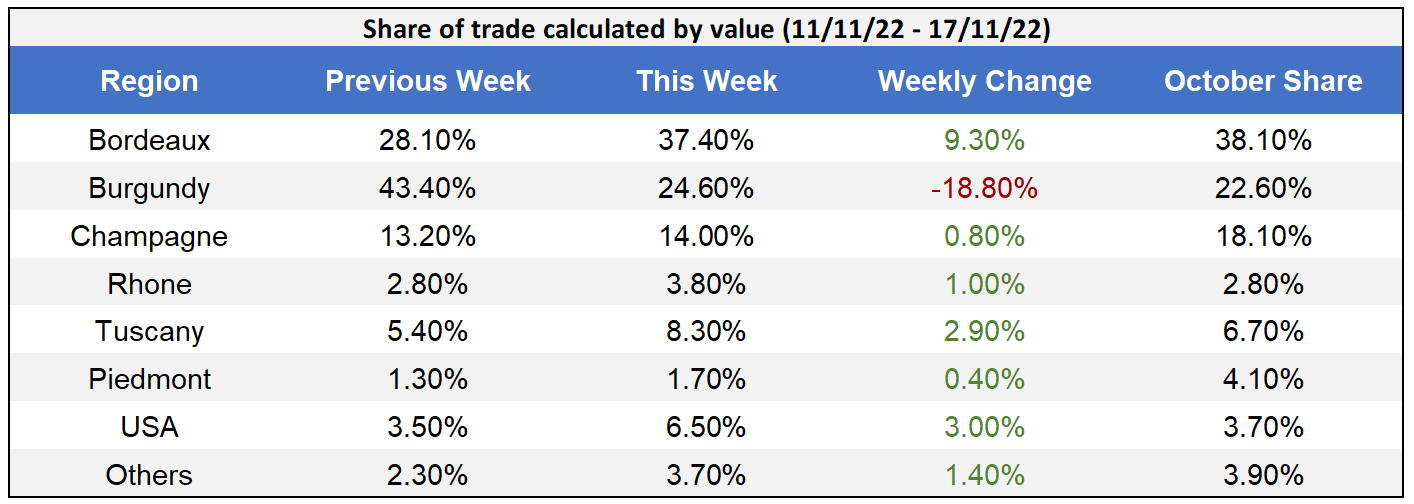

Weekly trade breakdown

With the exception of Burgundy, where trade decreased from a weekly record high of 43.4% last week to 24.6% this week, all major regions saw increases in trade. Burgundy’s annual trade share has reached an all-time high of 26.2% so far this year, with the 2018 & 2019 vintages being the most in demand. In 2021, Burgundy finished the year will an annual trade share of 22.0%.

Bordeaux’s activity this week was likewise dominated by the 2019 & 2018 vintages, and its trade share increased from 28.1% to 37.4%. The five First Growths (Lafite Rothschild, Mouton Rothschild, Latour, Haut-Brion, and Margaux) accounted for 25.1% of all Bordeaux trade.

Positive reports recently released by industry critics helped increased demand for Tuscan wines. Tignanello 2019 and Fattoria Le Pupill 2019 both had a busy week of trade after being included in the Wines Spectator’s top 100 rankings. However, it was Ornellaia 2010 that experienced the highest amount of trade this week for any Tuscan wine totaling £19,993.

The USA’s market share also climbed, rising from 3.5% to 6.5%. Harlan Estate 2018 and Opus One 2019 drove trade.

Germany (0.4%), Australia (0.8%), and Spain (1.1%) led trade for the ‘Others’ category.

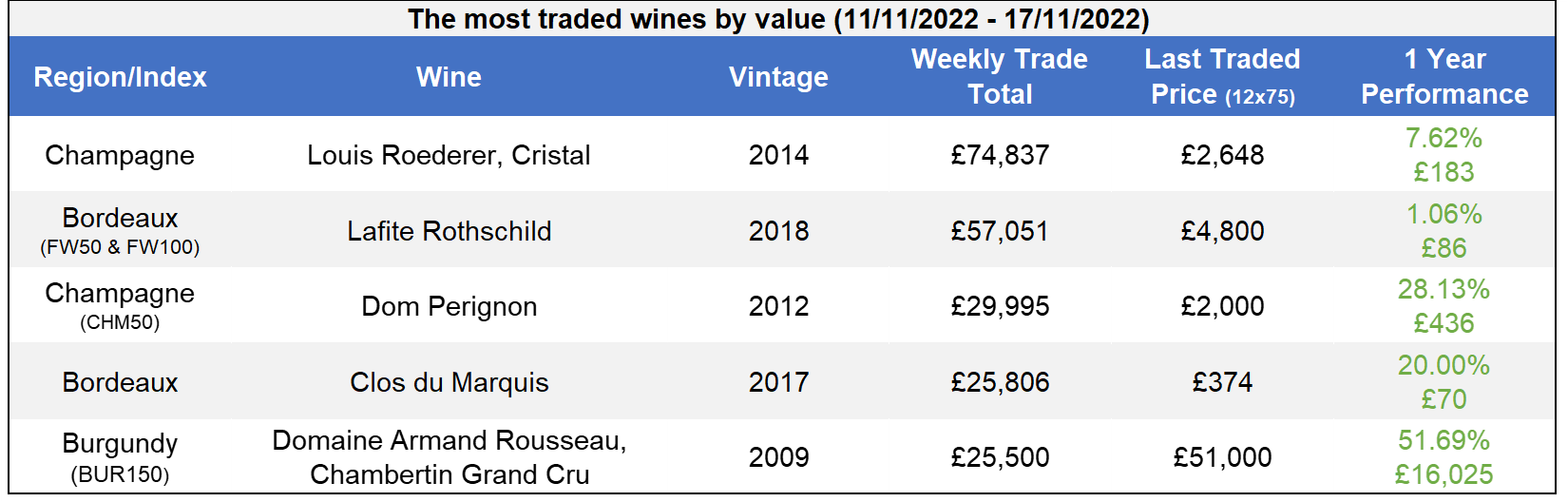

This week’s top traded wines

The most trade wine this week was Louis Roederer, Cristal 2014, which last traded at £2,648 per 12x75cl case, an increase of 9.2% from its initial release price in February this year.

Dom Perignon 2012 also made it onto the top trading list this week. Last traded at £2,000, Dom Perignon 2012 has increased in price by 51.5% since its release in September 2021.

Daily Markets 18/11/2022

What we’re reading

Related Articles

We are thrilled to announce the launch of our brand-new notifications page!

You can now create and manage multiple portfolios from your BordeauXchange account

Notifications